SANLORENZO I FIRST QUARTER 2023 CONSOLIDATED RESULTS

The Board of Directors of Sanlorenzo S.p.A. (“Sanlorenzo” or the “Company”), which met today under the chairmanship of Mr. Massimo Perotti, examined and approved the periodic financial information as of 31 March 2023.

Massimo Perotti, Chairman and Chief Executive Officer of the Company, commented:

«In line with our Business Plan 2023-2025, the results of the first quarter 2023 demonstrate the strength of the brand and the excellence of the business model of the Maison Sanlorenzo, which once again translate into increasing results, substantially in line with our forecasts. Our backlog is consistent and of high quality, 92% sold to final clients. The next deliveries are not available before summer 2025 for Yachts and before summer 2026 for Superyachts. This combination results in a high-degree visibility, well above the industry average, which allows for an enviable planning.

We are confident that the future of the sector will depend on innovation, especially in the field of sustainability. Therefore, by providing concrete answers and with a long-term vision to lead towards a zero-emission yachting transition, we continue to invest in research and development, confident of the path we have taken. We continue the strategic strengthening of our supply chain as demonstrated by the investments made to acquire the stake in Sea Energy and the acquisition of the majority of Duerre to ensure the procurement of key works and the supervision of the unique know-how offered by our territory».

CONSOLIDATED NET REVENUES NEW YACHTS

Net Revenues New Yachts in the first quarter of 2023 amounted to €183.7 million, up by 11.8% compared to €164.4 million in the same period of 2022.

The Yacht Division generated Net Revenues New Yachts equal to €117.4 million, in line with the annual budget targets.

The performance of the Superyacht Division, with Net Revenues New Yachts equal to €46.4 million, up by 41.4% compared to the first quarter of 2022, and Bluegame, with Net Revenues New Yachts equal to €19.9 million, up by 38.9% compared to the first quarter of 2022, were both outstanding.

The breakdown by geographical area confirmed, once again, the continuous expansion of the European market, up by 50.3% compared to the first quarter of 2022. The MEA area, up by 96.4%, largely compensated the slowdown in the Americas and APAC.

CONSOLIDATED OPERATING AND NET RESULTS

EBITDA amounted to €31.2 million, up by 21.2% compared to €25.7 million in the first quarter of 2022. The margin on Net Revenues New Yachts is equal to 17.0%, up by 130 basis points compared to the same period of 2022, as proof of the solidity of the business model and the ability to practice sustainable pricing policies, consistent with the brand positioning.

EBIT amounted to €24.2 million, up by 22.0% compared to €19.8 million in the first quarter of 2022. The margin on Net Revenues New Yachts is equal to 13.2%, up by 110 basis points compared to the same period of 2022, in spite of a 18.6% increase in depreciation and amortisation that stood at €7.0 million, following the implementation of the investments aimed at increasing production capacity and developing new products.

Pre-tax profit amounted to €24.0 million, up by 22.0% compared to €19.6 million in the first quarter of 2022.

Group net profit reached €17.2 million, up by 23.0% compared to €14.0 million in the first quarter of 2022. The margin on Net Revenues New Yachts is equal to 9.4%, up by 90 basis points compared to the same period of 2022.

CONSOLIDATED BALANCE SHEET AND FINANCIAL RESULTS

Net working capital was negative for €28.6 million as of 31 March 2023, compared to a negative figure of €37.0 million as of 31 December 2022 and a negative figure of €12.5 million as of 31 March 2022, a physiological normalisation, whilst also confirming the efficiency of the business model in terms of capital intensity invested.

Inventories were equal to €69.8 million, up by €16.4 million compared to 31 December 2022 and down by €3.8 million compared to 31 March 2022. The increase compared to the year-end figures is mainly due to raw materials and work-in-progress products, reflecting the progressive increase in backlog. Finished products were equal to €17.6 million, up by €9.4 million compared to 31 December 2022.

Organic net investments made in the first quarter of 2023 amounted to €6.0 million, substantially in line compared to €6.3 million in the same period of 2022, including 40% for product development and sustainability projects related to technologies based on fuel cells powered by green methanol, and 47% to increase production capacity. The incidence on Net Revenues New Yachts showed a further reduction, amounting to 3.3% in the quarter, mainly driven by an expanding revenue base, given a substantially stable average investment for a new model development.

Net cash position as of 31 March 2023 was equal to €108.1 million, compared to €100.3 million as of 31 December 2022 and €54.5 million as of 31 March 2022, an excellent result considering the typical seasonal pattern of the sector that tends to penalise the first quarter, driven by pricing-supported operating cash flow generation, combined with the increase in volumes.

Liquidity as of 31 March 2023 amounted to €213.2 million, of which €153.0 million referred to cash and €60.2 million referred to other current financial asset, up by €11.4 million compared to 31 December 2022 and €60.5 million as of 31 March 2022. Ready to seize new investment opportunities, the Company continues the flexible and diversified liquidity management strategy undertaken since the first half of 2022, with financial investments totalling €60.0 million as of 31 March 2023.

Financial indebtedness was equal to €105.0 million, of which €58.8 million current and €46.2 million non-current. Lease liabilities, included pursuant to IFRS 16, amounted to €8.7 million.

update on the strategy of verticalisation in key supply chains

acquisition of a minority stake in sea energy s.r.l.

On 23 March 2023, Sanlorenzo S.p.A. acquired a 49.0% stake in Sea Energy S.r.l., company active in the design, production and installation of electronics and electrical systems for the yachting sector, for an amount of €2,7 million. This transaction is strategically important for Sanlorenzo, which continues in the path of verticalisation of its key suppliers. In addition, the expertise and experience of Sea Energy will enable Sanlorenzo to benefit from an excellent and highly specialised know-how, aimed at developing projects in line with the sustainability of Sanlorenzo.

acquisition of a further stake in duerre s.r.l.

On 3 May 2023, Sanlorenzo S.p.A. closed the purchase of a further 33% stake in Duerre S.r.l., for a total consideration of €2 million, a company with a strong heritage since 1940s in the field of artisanal production of high-end furniture mainly for superyachts, as well as for residential real estate, offices, hospitality, and commercial buildings, reaching a 66% majority stake, given the previous acquisition of a 33% stake closed on 29 April 2022.

Constant expansion of the product portfolio, with the introduction of innovations and sustainable technologies

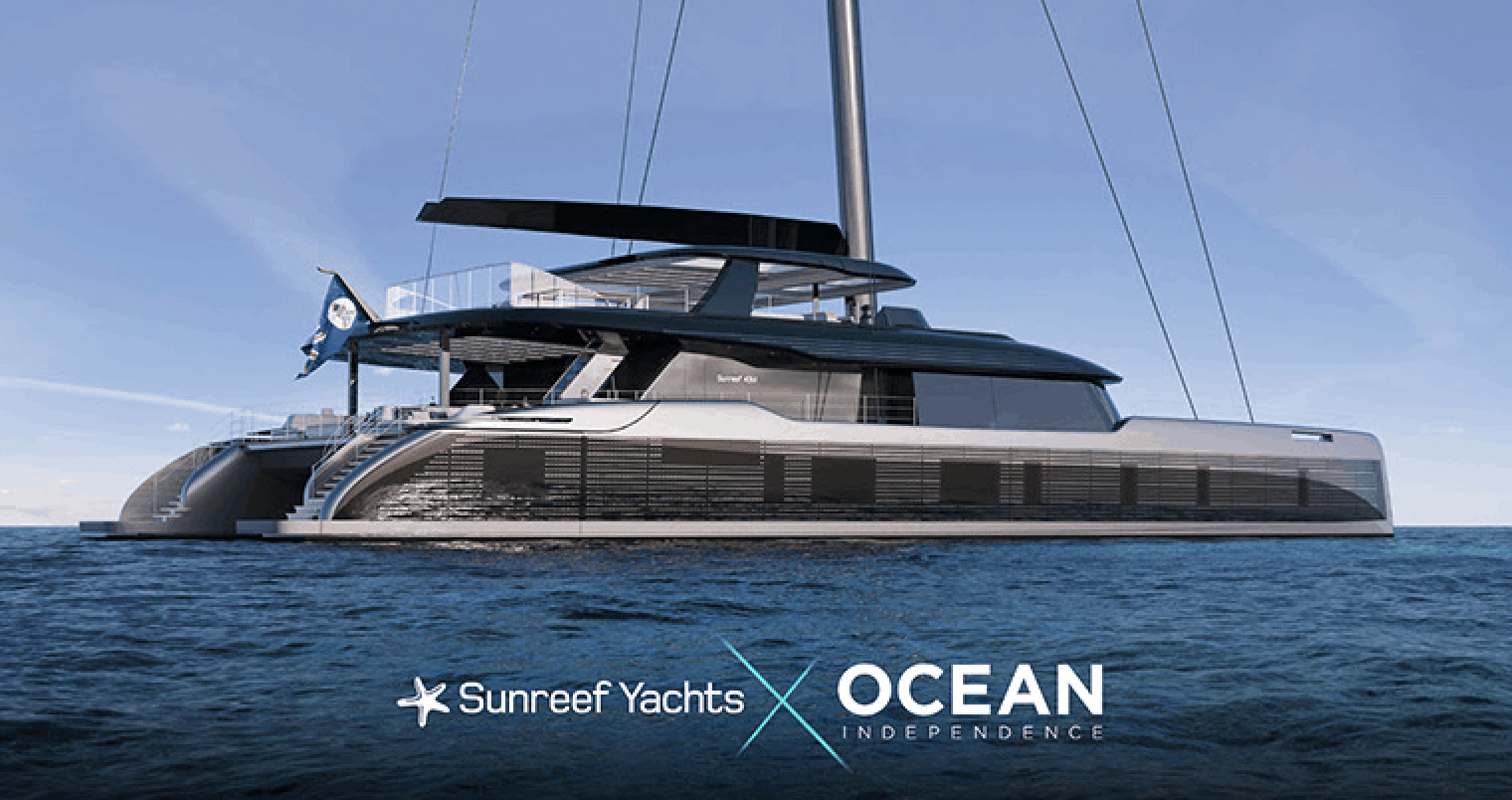

Alongside the continuous expansion of the existing ranges, the robust product pipeline of the Sanlorenzo Group includes two new lines (X-Space for the Superyacht Division and BGM – Bluegame Multi-Hull – for Bluegame), in addition to the Yacht Division’s SP Line (Smart Performance – open coupé) introduced in the second half of 2022, with which Sanlorenzo enters new high-potential market segments with novel products and primarily inspired by sustainability criteria, which are extremely well-received.

Sustainability is at the heart of the new product development strategy, which envisages an ambitious program that sees, for the first time in the nautical sector, the application of technologies focused on the marine use of methanol fuel cells, that will allow the progressive reduction of the environmental impact until carbon neutrality, the true answer to the demand for sustainability in the yachting industry.

The combined pressure resulting from the customer requests, increasingly focused to sustainability issues and responsible, and a more restrictive regulatory framework in terms of shipping emissions, ensures that a serious and long-term strategy on the sustainability of luxury yachting is no longer an option. In fact, although the yachting represents only 0.2% approximately of shipping emissions, the responsibility of UHNWIs is perceived to be far greater, as it relates to discretionary luxury product.