THE ITALIAN MARINE INDUSTRY ASSOCIATION BRINGS TOGETHER THE WORLDS OF YACHTING AND FINANCE AT THE MILAN STOCK EXCHANGE

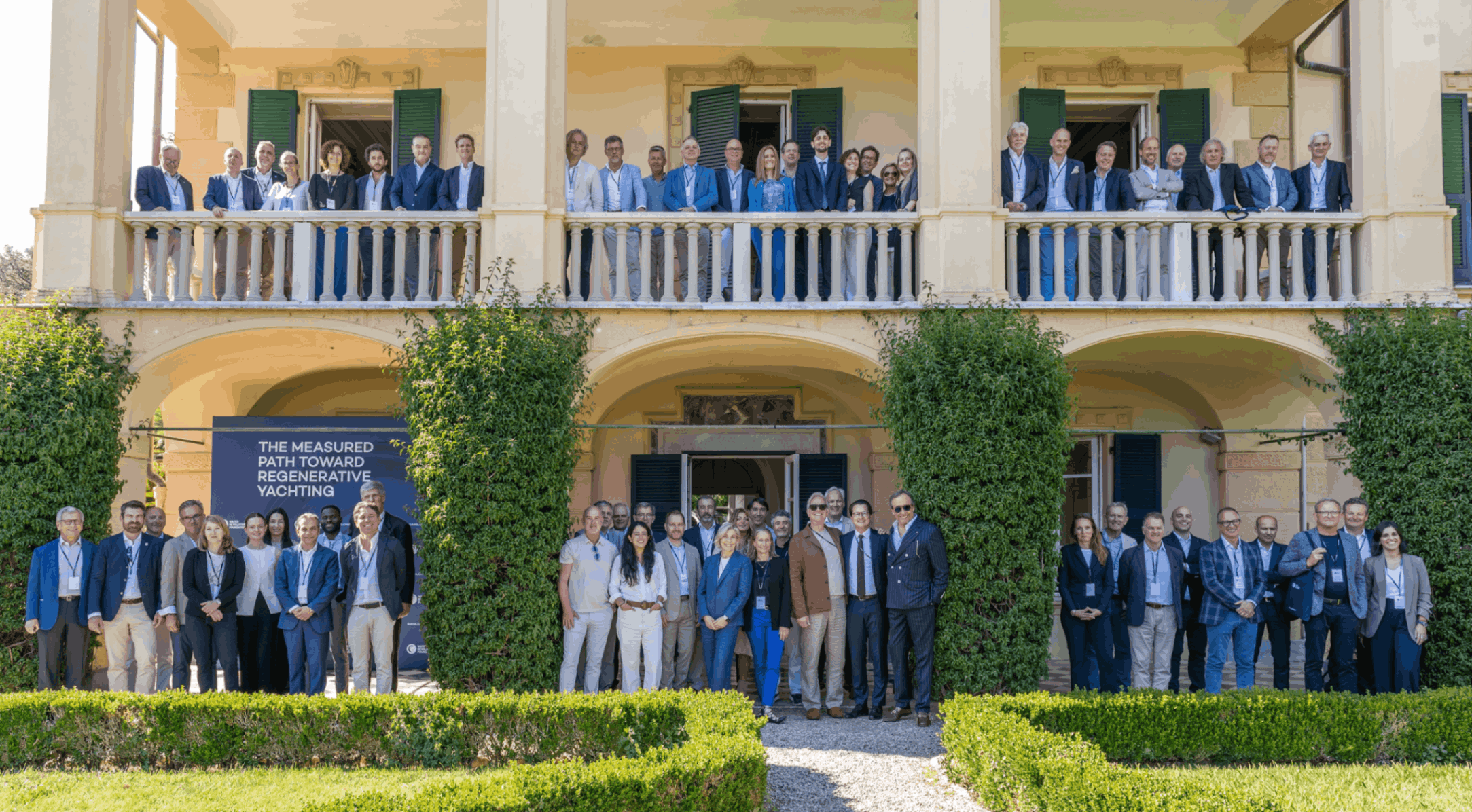

IN MILAN, ITALY’S MARINE INDUSTRY ASSOCIATION CONFINDUSTRIA NAUTICA, IN PARTNERSHIP WITH DELOITTE, BROUGHT TOGETHER ENTREPRENEURS FROM THE YACHTING INDUSTRY AND REPRESENTATIVES FROM THE WORLD OF FINANCE

As part of the event dedicated to presenting the study entitled “The state of the art of the global yachting market”, held yesterday at the Milan Stock Exchange, the Italian Marine Industry Association Confindustria Nautica, in partnership with Deloitte, brought together entrepreneurs from the yachting industry and representatives of the financial world for a roundtable discussion.

Taking part in the discussion, moderated by Radio 24 journalist Simone Spetia, were: Barbara Amerio, CEO and Sustainability Director of Gruppo Permare, Maurizio Balducci, CEO of Overmarine Group, Carla Demaria, Sanlorenzo Executive Director and CEO of Bluegame, Stefano de Vivo, Chief Commercial Officer of Ferretti Group & Managing Director of Wally, Fabio Planamente, CEO of Cantiere del Pardo S.p.A, Marzia Bartolomei Corsi, Senior Partner of Fondo Italiano d’Investimento SGR, Dario Cenci, Senior Partner of Armònia SGR, Michele Semenzato, Managing Partner of Wise Equity.

A key element of discussion amongst the various representatives of both the yachting industry and world of finance was how the yachting industry has confirmed once again its continued strength as a solid and constantly growing sector, demonstrating resilience, a great propensity for export, and exceptional potential for market penetration.

Dario Cenci: “Investors’ view of the yachting sector has changed. It is now considered an accurate example of Made in Italy excellence. Our country holds the second place in the yachting industry and first place when it comes to superyachts, while also demonstrating a clear vocation for exports and being made up of industrial districts. It is a pretty much ideal sector for those who want to invest in the Made in Italy brand and take advantage of the great potential on the horizon despite the uncertainties caused by the current war and all the consequences that have affected us in recent months.”

Marzia Bartolomei Corsi: “The yachting sector has become increasingly solid and resilient, having defined itself following the 2008 crisis. We are witnessing a combination of elements that have allowed the sector to benefit from prolonged development prospects. We need to make the most of the current challenges in order to take further steps forward through systemic interventions in terms of managerialisation, talent attraction and new skills that can bring added value to companies across the sector“.

Michele Semenzato: “Following the 2008 crisis, it is only recently that the world of finance has begun to approach that of yachting once again, and we are now experiencing a moment in time where the segment is clearly gaining appreciation once more. The fact that Italian production is focused on a high-end target – as shown by the data in the report put together by Deloitte – makes the entire sector stronger as a whole, with a constant growth in assets and low penetration. In addition to the growth in the number of HNWIs, the recent pandemic has contributed to an increase in the desire to enjoy yachting, clearing the path for remote work and helping to increase the time spent on yachts, even outside the usual summer holiday period. These trends, combined with the industry being a key part of the luxury sector, give us high hopes for the future resilience of the market, even in the event of a worsening of the current global economic slowdown“.

Barbara Amerio: “I have been analysing the route leading to listing a company on the stock exchange and, regardless of whether or not you want to go public, I strongly believe it is of enormous help for the growth of a company to study these procedures, regarding, above all, the levels of transparency and the sustainability reports required.

The yachting industry presents great potential for growth and an increasing need for space. And the pandemic has only highlighted that significant potential“.

Carla Demaria: “Listing on the stock exchange requires a rigour that is key for managing a company. It is a strong commitment. A promise to be kept. Also, from the standpoint of sustainability, being on the stock exchange pushes you to look beyond the present. With regards to ESG, we have involved the supply chain in our sustainability journey through the Sanlorenzo Academy, offering them financing tools through platforms with favourable conditions.

The market penetration rate is an incredible lever. The luxury sector has extremely high growth potential. As far as geographic areas are concerned, certainly the Asia-Pacific region offers significant potential being the region with the highest growth rate of High Net Worth Individuals.

In general, the average age of our buyers has dropped significantly from 60 to 48. Younger owners are much more focused on sustainability, they spend twice as much time on the boat and are much more connected.”

Stefano de Vivo: “The Ferretti Group has faced the journey that is managerialisation since the founder’s departure, with the adoption of rules that are determined by going public. Thanks to the resources deriving from the listing, a process of vertical integration has been able to flourish with a number of strategic suppliers on whom we do not, however, impose exclusive relationships.

With regards to customers, 48% of the contracts signed last year were from buyers who had never bought a boat measuring over 30 feet. For us, the outlook is positive and we believe considerably the Asia-Pacific region. In order to reduce geopolitical risk, we strive to diversify as much as possible across the international markets“.

Maurizio Balducci: “Right now there are many opportunities just waiting to be seized by companies operating in the sector.

Before considering bringing in an investment fund, companies have to structure themselves. It is a two-stage process that must involve both the company and a corporate partner. It is clear that the necessary condition to carry out this process requires an organisational commitment on the management side, which must be carefully planned out, also in view of the fact that companies are now significantly occupied with production given the growth rates of the yachting industry over the last two years.

From a market perspective, new buyers no longer buy boats as status symbols, but because they want to use them. Even the choice of boat size is made on the basis of the use they want to make of it and their family needs“.

Fabio Planamente: “Bringing a partner on board certainly helps a yard improve its procedures and become better structured, not only from a financial point of view, but also in terms of its general vision, especially in view of a possible approach to the stock exchange. In our business, there are so many important aspects that need to be evaluated and shared. It was our great fortune to find a partner with the awareness and willingness to understand a particular market. The added value of having a fund within our company was to have someone with whom we could compare ourselves, not so much from a product point of view, but to analyse all other aspects such as finances and business models. Flexibility and adaptability have become the keywords within the company”.