SOS YACHTING’S FISCAL

SOS YACHTING’S FISCAL ADVISORS AND REPRESENTATIVES REVEAL THE CURRENT STATE OF THE FISCAL AND CUSTOMS SCENARIO RELATED TO YACHT CHARTERING IN THE MED DURING THE WEEK OF THE MONACO YACHT SHOW.

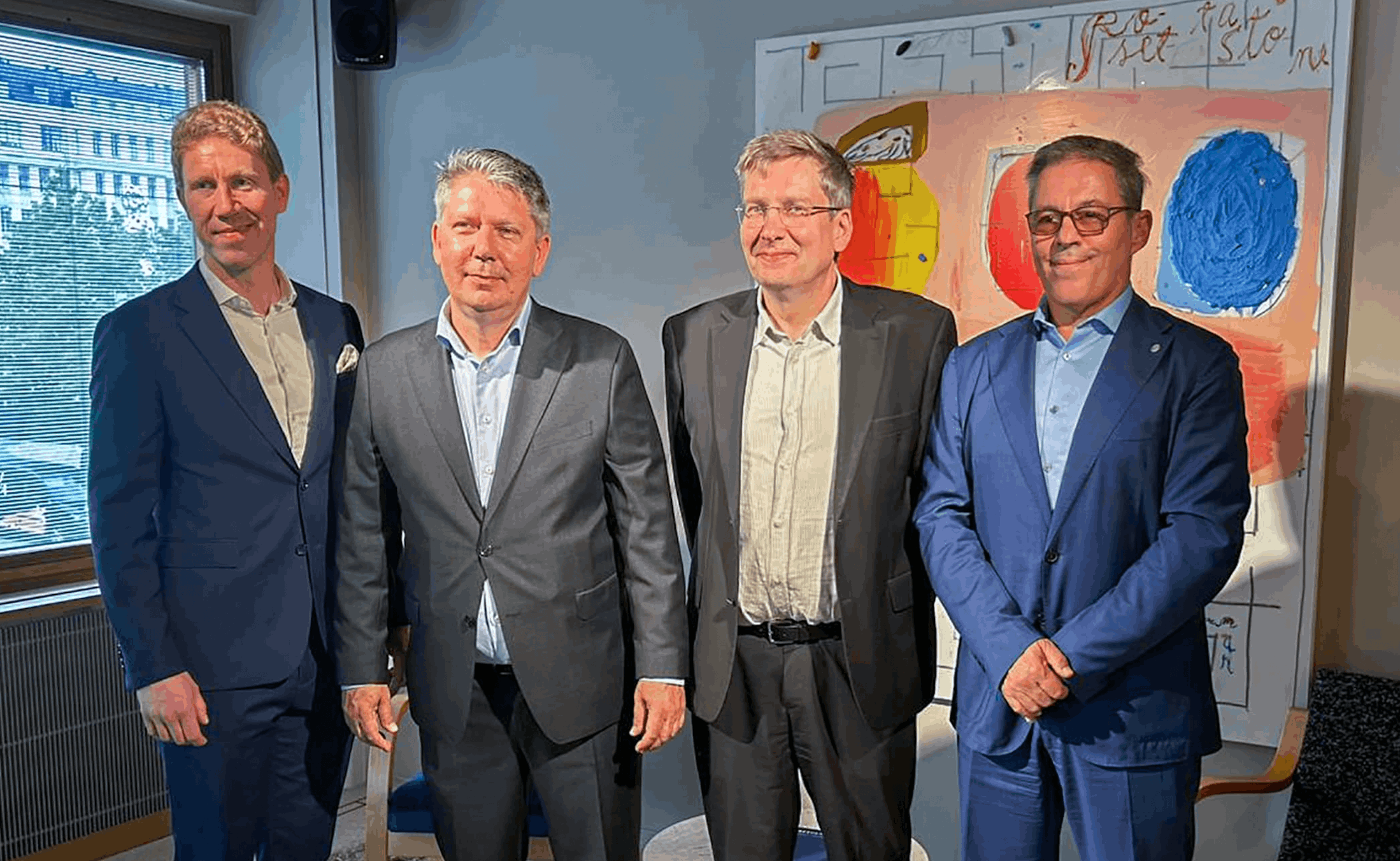

SOS YACHTING has for the 5th consecutive year organized a Fiscal meeting at the Hotel Hermitage in Monaco, the evening before the start of the Monaco Yacht Show. An event exclusively dedicated to cover Fiscal and Customs news and issues with regards to chartering in the Mediterranean. The panel was represented by SOS Yachting’s own fiscal advisors and representatives from Croatia, France, Italy and Spain and the event was attended by yachting industry stakeholders. Particular attention was given to the EU infringement proceedings related to the yachting sector, charter under temporary admission in Union waters, the return goods relief scheme and the latest about the 25% Customs duties on US built yachts, Brexit and

charter of British and red ensign flags and the situation of the upcoming charter season 2020.

24thSeptember 2019, SOS Yachting Fiscal meeting, Hotel Hermitage, Monaco

For 5 consecutive years, SOS Yachting has organized this meeting focused on giving the yachting industry an insight on the fiscal and customs side of chartering in the Med and the latest updates of new regulations and procedures in force in the four countries where they are based.

The panel for the evening was seated by SOS Yachting’s fiscal advisors and representatives:

Dorijan Dujmic, shareholder of SOS Yachting Croatia and Vice President of ASBAC

Ezio Vannucci, Fiscal advisor in Italy, partner Moores Rowland partners, Fiscal advisor of UCINA Miguel Angel Serra, Fiscal advisor in Spain, partner Albors Galiano Portales, Fiscal and Legal advisor of ANEN

Thierry Voisin, President of SOS Yachting France, President of ECPY and ex-president of MYBA Moderating the meeting was Mike Stones from the Superyacht Investor.

During the panel talk, Ezio Vannucci explained the current situation of the infringement proceeding opened by the EU Commission on Nov 8, 2018 against Italy and particular on: i) the application of the reduced VAT rate and also ii) on the excise duty exemption on fuels used for bunkering by yachts in used in charter activity.

Ezio pointed out that the commission decided to send on July 25, 2019 a “reasoned opinion” to Italy and Cyprus for not applying the correct amount of the VAT on short term lease contracts (no more than 90 days) of Yachts based on a reduced flat-rate VAT system depending on the length of the yacht, therefore today the Italian leasing scheme is not a part of this infringement.

The Italian tax authorities together with UCINA, the national yachting association, is currently working on the responds to the EU Commission in order to find a solution, in the meantime the current rules remain in place until further notice.

Regarding the other argument of the infringement, the EU Commission finally decided on July 25th, 2019 to refer Italy to the EU court of justice for its system on exemption on excise on fuel used for chartered yachts in EU waters, considering that current Italian rules allow to transfer the benefits of the excise duties from the owning company to the charterer.

In Spain, Miguel Angel Serra explained that there has been an evolution of the Matriculation tax and after 12 years of efforts trying to negotiate with the tax authorities no significant results were made, except for the exemption for charter activities, internal roads were exhausted. As a consequence, as it was announced in the ANEN Congress held in Palma last March, ANEN jointly with AEGY filed last July a formal complaint before the European Commission against Spain for the application of the matriculation tax (IEDMT).

Since the IEDMT is not a harmonized tax, in principle Spain have the right to impose a matriculation tax, but Miguel thinks that as it is regulated, especially in the taxable events and its interpretation by the tax authorities, it could be contrary to some of the main EU principles. The legal arguments put forward by ANEN and AEGY before the EC are the following:

1) The possible infringement of the principles of EU law, such as the freedom of movement of persons, services, capital and goods.

2) The possible violation of the principle of economic capacity, by establishing as a taxable person of that taxable event the “user” of the vessel, the latter being able to have nothing to do with the legal ownership of the vessel.

3) The possible interference with the customs regimes provided for means of transport in the Union Customs Code (e.g. Temporary Import Regime).

The application is already under review by the EC, which has a period of 12 months from the date of registration of the application (July 2019), to open infringement proceedings considering that there is an infringement of EU law or to file the complaint.

Thierry Voisin explained that the French Customs have applied the Customs regulation named “law of the return”. This regulation allows US built commercial yachts that have been imported prior to June 2018 to be reimported without payment of the additional 25 % Customs duty due for US built yacht.

25 % additional Customs duty do not impact on privately registered US built yachts because they are placed under a temporary admission regime that do not require importation to sail in EU waters.

Following the negotiation lead by the ECPY during winter 2018 /2019, the French Customs issued the instructions concerning the 25% of Custom duty during spring 2019. US built commercial yachts have to be exported at the end of the season before leaving EU waters in order to be imported without payment of the 25% additional tax for the 2020 Med season.

Note 1: all above is good concerning the 25% additional custom duty. Note 2: concerning the VAT it is necessary to be compliant with the 70% rules and be registered commercially in year N to benefit from VAT exemption on year N+1.

In Croatia, Dorijan Dujmic explained the situation of the chartering of passenger yachts whereas of this season 2019, authorities are recognizing the PYC (Passenger Yacht Code) so Passenger Yachts are allowed to charter in Croatia with a maximum of 36 guests on board and they pay the standard 13% VAT rate.

It is important to point out this reflects only to crafts with the wording Yacht on their Certificate of Registry.

On the other hand, in Croatia there are also passenger vessels that are also allowed to carry more than 12 guests and conduct charter operations but only as International voyage, since they don’t pay VAT on charter. International voyage means that the guests should be picked up outside Croatia.